Donald Trump Wants $1 Trillion Investment from Saudi Arabia

U.S. President Donald Trump announced he would request Saudi Arabia to increase its planned investment in the U.S. from $600 billion to $1 trillion during a virtual address at the World Economic Forum in Davos.

Donald Trump Wants $1 Trillion Investment from Saudi Arabia

This investment is intended to span the next four years, aligning with Saudi Crown Prince Mohammed bin Salman’s commitment to expand economic ties with the U.S. The discussions emphasized mutual benefits and potential for enhanced bilateral relations as both nations seek to capitalize on available opportunities.

Sectors Likely to Benefit from the Investment

The potential $1 trillion investment from Saudi Arabia could significantly benefit several key sectors in the U.S.:

Clean Energy

Investments in renewable energy projects, including green hydrogen, are expected to grow, supported by federal initiatives.

Semiconductors

The semiconductor industry is poised for expansion as demand increases for advanced electronics.

Healthcare

This sector may see growth through advancements in medical technology and AI-driven solutions.

Infrastructure Development

Companies involved in construction and maintenance of infrastructure projects are likely to benefit from increased funding.

Potential Risks of Saudi Investments in the U.S.

Saudi investments in the U.S. pose several potential risks:

National Security Concerns

There are worries about foreign control over sensitive technologies and industries, which could compromise U.S. national security. Investments in companies like Twitter raise alarms about data privacy and influence over communication platforms.

Human Rights Issues

Saudi Arabia’s poor human rights record may lead to ethical dilemmas for U.S. companies involved, potentially damaging their reputations and leading to public backlash.

Market Access Restrictions

Saudi Arabia’s regulatory environment can create challenges for U.S. businesses, including compliance with local standards that may differ from international norms.

Political Risks

Ongoing geopolitical tensions and shifts in U.S.-Saudi relations could impact investment stability and predictability, affecting long-term business strategies.

Comparison to Other Major Foreign Investments in the U.S.

The proposed $1 trillion Saudi investment in the U.S. significantly surpasses typical foreign direct investment (FDI) levels. In 2022, total FDI inflows to the U.S. were approximately $285 billion, with major contributors being countries like Japan, Canada, and Germany.

The Saudi investment would represent a substantial single commitment compared to the average daily foreign investment of over $5 billion during 2002-2006. Additionally, while the U.S. FDI stock reached around $10.46 trillion in 2022, Saudi Arabia’s contribution would notably enhance its position within the manufacturing and clean energy sectors.

Long-Term Economic Benefits

The potential long-term economic benefits of the proposed $1 trillion Saudi investment for both the U.S. and Saudi Arabia include:

Economic Diversification for Saudi Arabia

This investment aligns with Saudi Vision 2030, helping the kingdom diversify its economy away from oil dependency, fostering growth in sectors like technology, renewable energy, and infrastructure.

Job Creation in the U.S.

Increased Saudi investments could lead to job creation in various sectors, particularly in technology, defense, and construction, benefiting American workers and companies.

Strengthened Bilateral Relations

Enhanced economic ties may solidify diplomatic relations, leading to greater collaboration on security and geopolitical stability in the region.

Access to Capital Markets

Saudi investments can provide U.S. firms with capital for expansion while offering Saudi Arabia a stable investment environment for its sovereign wealth fund.

The proposed $1 trillion Saudi investment represents a transformative opportunity for both the U.S. and Saudi Arabia. It holds the potential to strengthen economic ties, create jobs, and promotes innovation across critical sectors. While challenges like national security and ethical concerns remain, the mutual benefits of this collaboration could show the way for a prosperous and sustainable partnership.

Congressman Proposes Ban on Chinese Student Visas

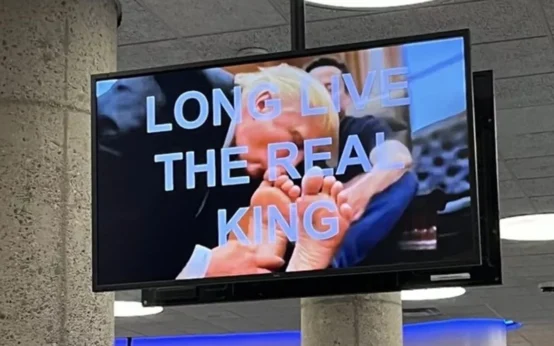

Congressman Proposes Ban on Chinese Student Visas  AI generated video of Trump and Musk appears on TV of HUD

AI generated video of Trump and Musk appears on TV of HUD  Samay Raina shares a surprise post on his YouTube channel

Samay Raina shares a surprise post on his YouTube channel  Apple ready to launch budget friendly iPhone 16e

Apple ready to launch budget friendly iPhone 16e  Champion League DRAMA & Unexpected Outcomes

Champion League DRAMA & Unexpected Outcomes  Mahakumbh: Dead Man Khunti Returns Alive

Mahakumbh: Dead Man Khunti Returns Alive