Trump’s Tariff War Triggers Global Stock Market Crash

U.S. President Donald Trump has defended his sweeping tariff policies during a severe global stock market sell-off. Speaking on Air Force One, Trump compared the economic pain to “medicine” required to fix trade imbalances.

He explained, “I don’t want anything to decline, but sometimes you have to take medicine to remedy a situation,” minimizing the concerns about trillions lost in global market value.

The tariffs, starting at 10% and rising up to 50% on certain nations, have raised fears of a global recession. Financial markets around the world saw heavy losses as analysts warned of one of the worst market routs in history. Trump maintained his hard stance, targeting trade deficits with nations like China and demanding high payments from foreign governments for any tariff relief.

Asian Stock Markets Suffer Record Losses

Asian markets saw some of their sharpest declines in decades. Japan’s Nikkei 225 plunged nearly 9%, triggering circuit breakers, while the TOPIX index lost 8%.

China’s Shanghai Composite dropped over 6%, and Hong Kong’s Hang Seng Index fell by about 10%. Tech giants like Alibaba and Tencent suffered over 10% losses. South Korea and India also faced significant drops, with the Kospi and Sensex each down more than 5%.

European and U.S. Stock Markets Also Affected

European markets recorded steep losses. Germany’s DAX index fell 9%, London’s FTSE declined 5%, France’s CAC 40 dropped 4.3%, and Spain’s IBEX35 lost 5%. In the U.S., stock futures continued downward, with the S&P 500, Dow Jones, and Nasdaq each signaling declines over 4%.

These losses followed China’s retaliatory tariffs of 34%, deepening fears of a prolonged trade conflict.

Rising Investor Concerns and Recession Risks

Trump’s tariff policies have sparked concerns over inflation, slowing demand, and falling investor confidence. JPMorgan raised its estimate of a global recession to 60%, while Goldman Sachs put the chance of a U.S. recession within the next year at 45%.

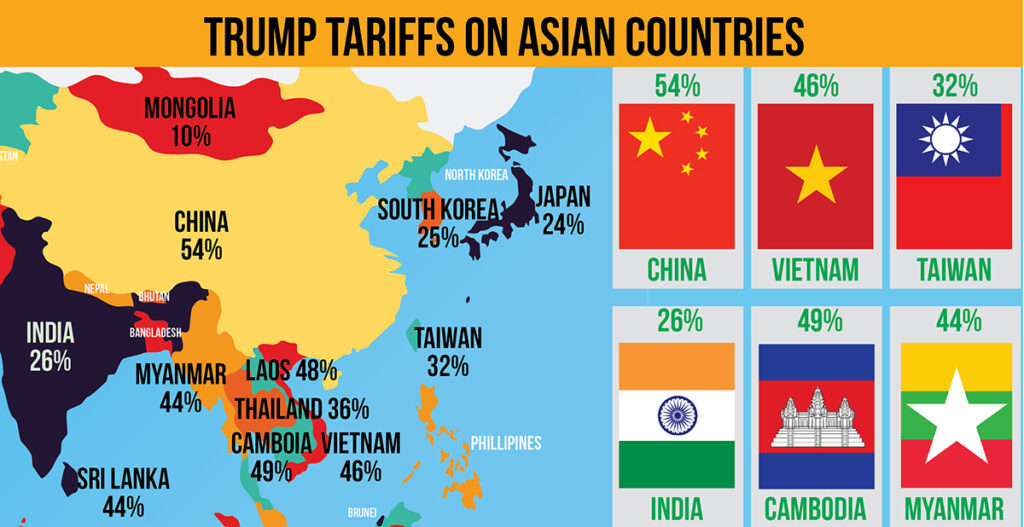

Asian Sectors Most Affected by Trump’s Tariffs

Manufacturing and Consumer Goods

Vietnam, Cambodia, and Laos, known for exporting textiles and apparel, now face tariffs up to 49%, straining their manufacturing industries.

Electronics and Semiconductors

Taiwan, South Korea, and Malaysia, key

electronics producers, face tariffs of 32% and 25%, disrupting tech supply chains worldwide.

Steel and Aluminum

Vietnam, Taiwan, and South Korea’s steel and aluminum sectors remain vulnerable due to earlier U.S. tariffs targeting these exports.

Read this:

Intermediate Goods

Indonesia and Malaysia, which supply parts used in China’s manufacturing sector, face indirect impacts as U.S. tariffs slow Chinese production.

Textiles

Bangladesh and Vietnam’s textile exports face tariffs of 37% and 46%, putting pressure on their garment industries.

Countries Most Affected

- Vietnam: Faces a 46% tariff, heavily impacting its export sector.

- Cambodia and Laos: Suffer from the highest tariffs of 49% and 48%.

- Taiwan: Electronics industry exposed to a 32% tariff.

- South Korea: Electronics and steel exports face a 25% tariff.

Trump’s tariff war affects not just direct exports but also wider Asian supply chains. Countries integrated with China’s manufacturing sector or highly dependent on U.S. trade are seeing reduced demand, falling investments, and potential production shifts to lower-tariff regions like Singapore and the Philippines.

Trump Disappointment Over Russian Strikes

Trump Disappointment Over Russian Strikes  M&S Halts Agency Work After Major Cyberattack

M&S Halts Agency Work After Major Cyberattack  U.S. Airstrike Kills Dozens of African Migrants

U.S. Airstrike Kills Dozens of African Migrants ![An ambulance is parked at the site of the Lapu Lapu event in Vancouver [Jennifer Gauthier/Reuters]](https://worldinfo.news/wp-content/uploads/2025/04/Car-Crashes-into-Vancouver-Festival-Kills-Several-554x346.webp) Car Crashes into Vancouver Festival Kills Several

Car Crashes into Vancouver Festival Kills Several  Trump Meets Zelensky, Questions Putin’s Peace Intentions

Trump Meets Zelensky, Questions Putin’s Peace Intentions  Kashmir Tensions Rise After Attack and Border Clashes

Kashmir Tensions Rise After Attack and Border Clashes