Impact of U.S.-China Tariffs on the Global Economy

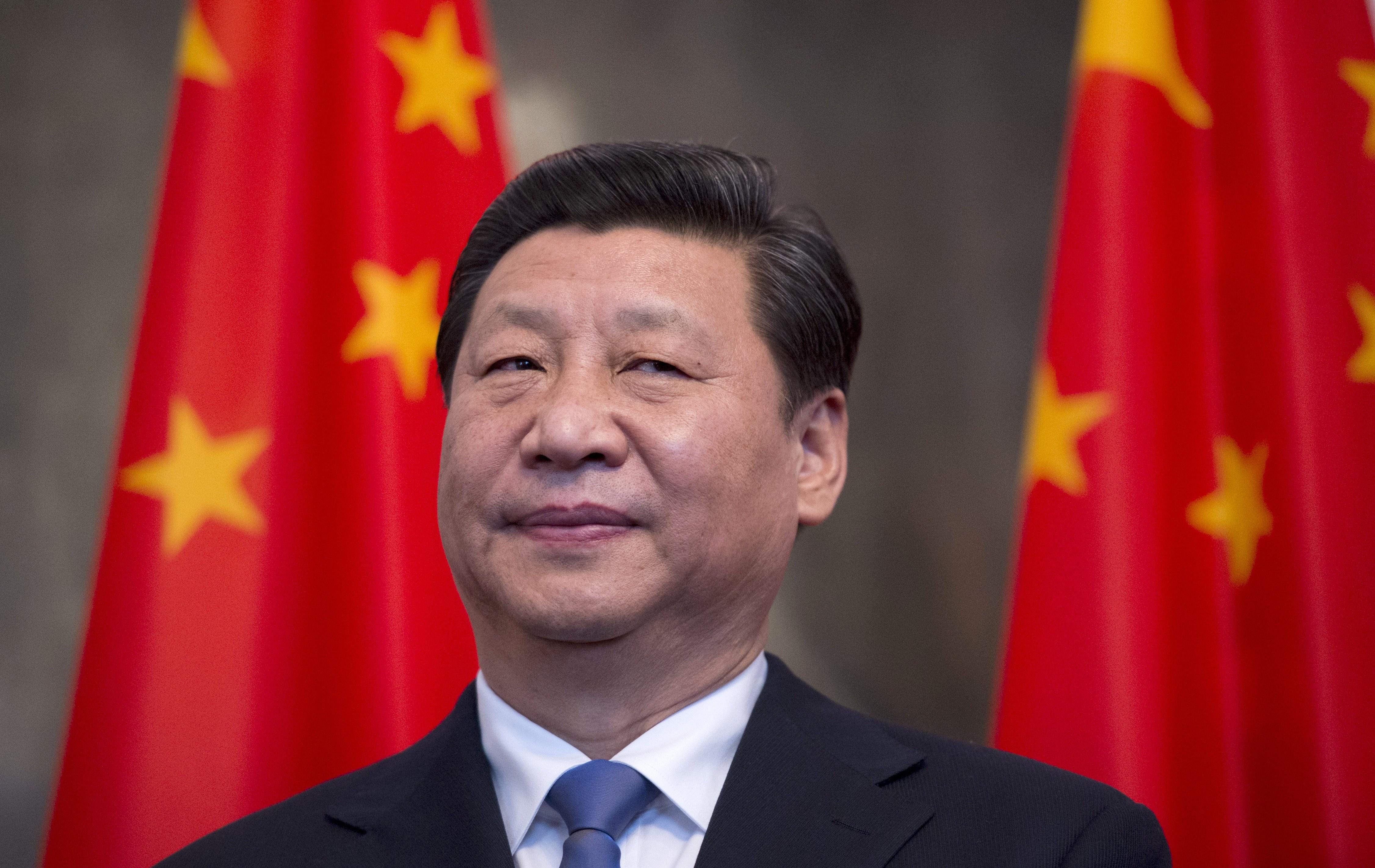

The escalating trade tensions between the United States and China have entered a new phase. China’s recent decision to impose tariffs on American goods is a direct retaliation to U.S. tariffs on Chinese imports.

Impact of U.S.-China Tariffs on the Global Economy

This development not only strains bilateral relations but also poses significant risks to the global economy. The following analysis highlights key developments, economic impacts, and broader implications.

Key Developments

Tariff Implementation

China announced a 15% tariff on U.S. imports of coal and liquefied natural gas (LNG), effective February 10, 2025. Additionally, a 10% tariff will apply to U.S. crude oil, agricultural machinery, and large vehicles.

Read this:

Reason for Retaliation

The Chinese government stated that these measures respond to U.S. actions that undermine normal economic cooperation. China’s Finance Ministry emphasized that such tariffs hinder efforts to resolve trade tensions.

Market Reactions

Following the announcements, U.S. stock markets declined. The Dow Jones dropped by 0.3%, while the S&P 500 fell by 0.8%, reflecting investor concerns over trade uncertainties.

Broader Implications

The renewed conflict will likely impact U.S.-China relations, global markets, and supply chains. Analysts predict economic repercussions as tariffs raise costs and disrupt trade flows.

Context of the Trade War

This round of tariffs adds to disputes escalating since Trump’s first term. The U.S. aims to address perceived unfair trade practices, focusing on intellectual property and market access.

Tariffs’ Impact on the Global Economy

Economic Growth Slowdown

The U.S. GDP may shrink by 0.7 percentage points in 2025 due to tariffs. While a recession is unlikely, growth will slow. The Tax Foundation estimates a 0.4% to 1% GDP reduction, depending on retaliation levels.

Impact on Canadian and Mexican Economies

Canada and Mexico may face severe effects due to heavy reliance on U.S. exports. Mexico’s GDP could contract, as U.S. exports make up over 25% of its economy.

Inflationary Pressures

Tariffs raise import costs, driving up inflation.

POLITICO

Consumer prices may increase modestly, reducing purchasing power. Central banks will face challenges balancing growth with inflation control.

Supply Chain Disruptions

Global supply chains will face disruptions, increasing costs and inefficiencies. U.S. businesses relying on imports may lose competitiveness, leading to job losses.

Retaliation and Trade Relations

Countries affected by U.S. tariffs plan to retaliate, risking further trade barriers. This tit-for-tat escalation could fragment global trade relations.

Currency Fluctuations

Tariffs may weaken currencies of affected nations, making their exports cheaper. For instance, the Mexican peso has depreciated since earlier tariffs.

The imposition of tariffs by the U.S. and China will likely have negative effects on global economic growth. While some sectors may benefit temporarily, the overall impact includes slower growth, higher inflation, and disrupted trade relations. Managing these challenges will require strategic policy adjustments from governments and central banks worldwide.

OECD Warns Trump : Tariffs Are Harming Global Economy

OECD Warns Trump : Tariffs Are Harming Global Economy  How InnoMake Shoes Make Navigation Safer for the Blind

How InnoMake Shoes Make Navigation Safer for the Blind  New Coronavirus Wave Hits India: What We Know

New Coronavirus Wave Hits India: What We Know  Trump Threatens 25% Tariff on iPhones and Other Smartphones

Trump Threatens 25% Tariff on iPhones and Other Smartphones  Did Trump Halt Harvard’s Foreign Enrollment?

Did Trump Halt Harvard’s Foreign Enrollment?  World’s Most Populous Cities: Population, Living Conditions, and Health

World’s Most Populous Cities: Population, Living Conditions, and Health