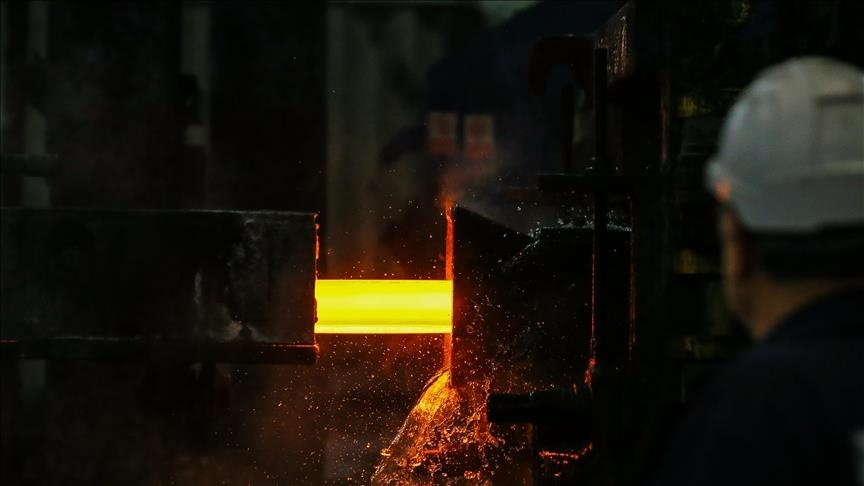

India Imposes 12% Tariff on Steel Imports to Counter Cheap Chinese Supplies

India has imposed a 12% temporary tariff on steel imports to curb a flood of cheap steel, mainly from China.

The move aims to protect local steelmakers struggling with low-cost imports. This tariff, known as a safeguard duty, will last 200 days unless changed earlier.

India Imposes 12% Tariff on Steel

Yes, the tariff is real. Reuters reported on April 21, 2025, citing a government source, that India’s Ministry of Finance issued an order for the 12% duty.

The Directorate General of Trade Remedies (DGTR) recommended it in March after a probe started in December 2024. Major steelmakers like JSW Steel and Tata Steel pushed for this to shield the industry.

Who Announced It?

The Ministry of Finance made the official announcement. A government source, unnamed, confirmed the decision to Reuters.

The DGTR’s recommendation followed concerns from India’s steel industry body, including companies like Steel Authority of India and ArcelorMittal Nippon Steel.

Why Is India Doing This?

Cheap steel imports, especially from China, have hurt Indian steel mills. In 2024/25, India imported 9.5 million metric tons of finished steel, a nine-year high.

China, the world’s top steel producer, was the second-largest exporter to India after South Korea. The influx forced smaller mills to cut operations and consider job losses. The tariff aims to boost local industry and prevent “serious injury” to domestic producers.

Chinese Official Reaction

No direct Chinese government response to the 12% tariff has been reported. However, Guo Xuetang, director of Shanghai University’s Research Centre for South Asia, told China Daily that the tariff won’t significantly hurt China-India trade.

He said India still needs China’s cost-effective steel for infrastructure projects like bridges. Guo urged more communication to maintain cooperation.

India-China Trade Relations

India and China share a complex trade relationship, strained by a 2020 border clash in Ladakh. Despite tensions, China is India’s top trading partner. Bilateral trade hit $118.4 billion in FY24.

Read this:

India relies heavily on Chinese electronics, machinery, and chemicals but faces a massive trade deficit. Both nations are BRICS allies and are exploring cooperation to counter U.S. tariffs. Recent talks between leaders signal a thaw in ties.

Trade Numbers

- Total Trade (FY24): $118.4 billion.

- India’s Imports from China (FY24): $101.74 billion (15.06% of India’s total imports).

- India’s Exports to China (FY24): $16.65 billion.

- Trade Deficit (FY25): $99.2 billion, a record high.

- Key Imports from China (Apr-Nov 2024): Electrical machinery ($24.44 billion), nuclear reactors ($16.98 billion), steel ($1.8 billion).

- Key Exports to China (FY24): Iron ores ($3.63 billion), engineering goods ($2.65 billion).

- Chinese FDI in India (Apr 2000-Sep 2024): $2.5 billion (0.35% of total FDI).

Why Trump Is Taking Action Against China’s Graphite Dominance

Why Trump Is Taking Action Against China’s Graphite Dominance  Trump’s $21M USAID Claim for India Elections Never Existed

Trump’s $21M USAID Claim for India Elections Never Existed  Did India Strike Pakistan’s Nuclear Hub Kirana Hills?

Did India Strike Pakistan’s Nuclear Hub Kirana Hills?  What’s Happening in Iran: India Urges Citizens to Exit

What’s Happening in Iran: India Urges Citizens to Exit  Why Did Bangladesh Choose Mangoes for PM Modi?

Why Did Bangladesh Choose Mangoes for PM Modi?  China Unveils World’s Lightest Brain Chip to Control Bees

China Unveils World’s Lightest Brain Chip to Control Bees