Apple Watch Shipments Drop , Facing Tough Competition

Significant Decline in 2024

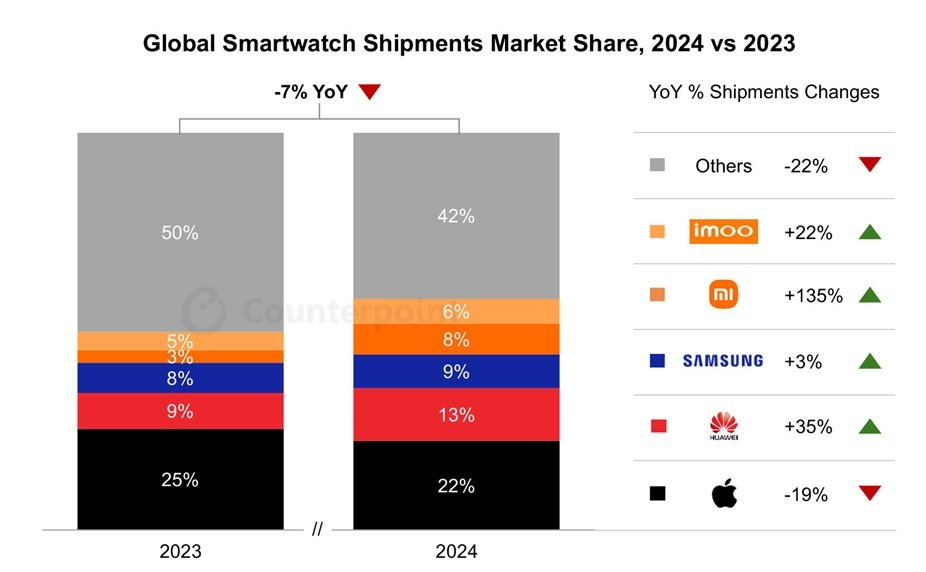

Apple Watch shipments fell 19% in 2024, marking the second consecutive year of decline, according to Counterpoint Research’s Global Smartwatch Shipment Tracker for Q4 2024.

This follows a 10% drop in 2023. The decline was notable in North America, which accounts for over half of Apple’s smartwatch shipments. India was the only region to show growth. The global smartwatch market also shrank by 7% in 2024, the first annual decrease ever.

Apple’s market share in the advanced smartwatch segment dropped by 8 percentage points, highlighting a challenging year for the tech giant.

Background of the Apple Watch’s Struggles

The Apple Watch, launched in 2015, initially struggled to find its place but soared after focusing on health and fitness features. Shipments grew steadily, peaking with a 27% increase in 2021. However, growth stalled in 2022, followed by declines in 2023 and 2024.

The lack of major upgrades in recent models, like the Apple Watch Series 10, has left consumers with little reason to upgrade. Legal issues, such as the removal of the blood oxygen sensor in the U.S. due to patent disputes, further hurt appeal. The absence of new Apple Watch SE and Ultra models since 2022 and 2023, respectively, also impacted sales, as these lines typically drive significant shipment numbers.

Global Market Position

Despite the declines, Apple remains the leader in the advanced smartwatch segment by unit volume. The Apple Watch Series 10, Ultra 2, and SE cater to a wide range of iPhone users, offering features like fitness tracking, notifications, and app integration.

However, Apple’s global market share fell from 25% to 22% in 2024. North America remains its largest market, but declining interest there has hit hard. In contrast, India’s growing demand offers a bright spot. Competitors are closing the gap, particularly in regions where Apple’s premium pricing is less appealing.

Rising Competition

Apple faces stiff competition from brands like Huawei, Xiaomi, Samsung, and Garmin. Huawei saw 35% shipment growth in 2024, capturing a 13% market share, while Xiaomi’s shipments surged 135%, entering the top five global manufacturers.

These Chinese brands offer feature-rich smartwatches at lower prices, appealing to cost-conscious consumers. Garmin’s fitness-focused devices also gained traction, with global sales growing in 2024.

Samsung’s Galaxy Watch series, designed for Android users, continues to compete with Apple in the premium segment. Unlike Apple, these competitors have introduced new models and features, fueling their growth.

Reasons for the Decline

Several factors explain Apple’s shipment slump. First, the Apple Watch Series 10 offered only minor upgrades, failing to excite consumers. Second, the lack of new SE and Ultra models reduced options for budget and premium buyers.

Third, patent disputes forced Apple to disable the blood oxygen feature in the U.S., diminishing the watch’s health-tracking appeal. Fourth, North American consumers are becoming more price-sensitive, turning to cheaper alternatives from Huawei and Xiaomi.

Finally, U.S. tariffs on imports from China, Vietnam, and India, introduced in 2025, may raise prices and disrupt supply chains, potentially worsening the decline. Counterpoint suggests Apple needs new features, updated SE and Ultra models, and design changes to recover in 2025.

Apple’s dominance in the smartwatch market is under pressure. While it still leads, the company must innovate to counter growing competition and regain consumer interest. Analysts predict single-digit growth for the global smartwatch market in 2025, offering Apple a chance to rebound if it can deliver compelling new models and features.

Trump Threatens 25% Tariff on iPhones and Other Smartphones

Trump Threatens 25% Tariff on iPhones and Other Smartphones  Apple Shifts Device Production to India and Vietnam

Apple Shifts Device Production to India and Vietnam  Russia Sues Apple Over LGBT Pride Wallpaper

Russia Sues Apple Over LGBT Pride Wallpaper  Apple Patents Touchscreen AirPods Case

Apple Patents Touchscreen AirPods Case  The U.S. threatens to apply 50% tariffs to China

The U.S. threatens to apply 50% tariffs to China  Is Apple developing AirPods with a camera?

Is Apple developing AirPods with a camera?