Nepal’s ride-hailing landscape has seen significant changes in recent years. Dominated for a long time by platforms like Pathao and inDrive, the market experienced a major disruption in late 2023 with the entry of Yango, a global ride-hailing service backed by the Russian tech giant Yandex. Within months, Yango managed to gain attention with its ultra-affordable pricing, AI-powered operations, and a business model that prioritizes scalability with minimal overhead.

As urban centers like Kathmandu and Pokhara continue to grapple with traffic congestion, rising transportation costs, and uneven driver experiences, Yango’s entry signals a fresh approach to how ride-sharing can work not just in Nepal, but in emerging markets worldwide.

What is Yango and Why Is It Unique?

At its core, Yango is a digital-first ride-hailing platform that operates in over 20 countries across Africa, the Middle East, Latin America, and now South Asia. Its parent company, Yandex, is often compared to Google for its dominance in Russia’s tech ecosystem. Yango leverages Yandex’s expertise in AI and logistics to offer a smarter, faster, and more cost-effective mobility service.

What makes Yango truly unique is how it has reimagined the traditional ride-sharing business model. Instead of investing heavily in physical offices or large teams, Yango uses technology and local partnerships to manage its operations. This model dramatically reduces operational costs and allows the company to scale quickly in emerging markets like Nepal.

Yango’s Launch in Nepal Strategic Move

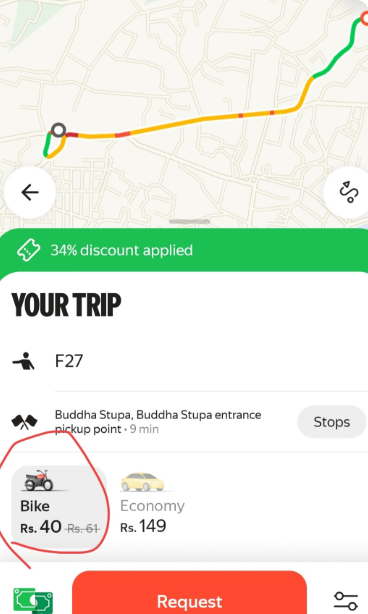

When Yango launched in Kathmandu and Pokhara in 2023, it didn’t follow the usual playbook. There were no flashy ad campaigns or promotional events. Instead, it focused on delivering real value through affordability and reliability. Commuters immediately took notice. Many found that Yango’s fares were significantly lower sometimes by as much as 70% compared to Pathao and inDrive during peak hours.

For drivers, Yango offered an equally compelling deal. With a lower commission rate and flexible operating model, many drivers began to switch platforms or work across multiple services, giving Yango a solid base of supply within weeks of its launch. Its rapid acceptance in the market sent a strong signal: this was not just another app looking to experiment Yango had come to compete and win.

How Yango Operates The Business Model Behind the Buzz

Yango’s fast rise in Nepal’s ride-hailing market isn’t just because of cheap fares it’s the result of a well-designed, tech-driven business model that focuses on being efficient, flexible, and affordable. The company doesn’t rely on traditional methods like maintaining offices or managing its own fleet. Instead, it uses advanced technology and partnerships with local companies to keep costs low and scale quickly. Here’s a closer look at how Yango’s business model works behind the scenes.

1. Smart Pricing with AI Making Rides Affordable and Fair

A key part of Yango’s system is its AI-powered pricing engine. Unlike other platforms in Nepal that use surge pricing or let riders and drivers negotiate fares, Yango uses real-time artificial intelligence to automatically calculate the most suitable fare for each ride. This system looks at several factors such as current traffic conditions, the total distance and estimated time of the trip, time of day, demand in specific areas, and how many drivers are nearby.

This kind of dynamic pricing helps keep fares consistently low for riders while making sure drivers can still earn a steady income. Since the AI adjusts prices based on real-world conditions, it avoids sudden or extreme fare hikes and ensures a smoother and fairer experience for both sides.

2. Low Commissions Putting More Money in Drivers’ Pockets

One of the most attractive features of Yango’s platform for drivers is its low commission rate. Most ride-hailing services in Nepal take between 20% to 30% of a driver’s earnings per ride. Yango, on the other hand, charges only 10% to 15%. This small difference makes a big impact over time. Drivers end up keeping more of their income, which helps improve their job satisfaction and encourages more drivers to join or stay on the platform.

This strategy is not just good for drivers it’s smart for Yango, too. By offering better earning potential, the company ensures it always has enough drivers on the road to meet rider demand, especially during peak hours or in busy areas.

3. No Need for Offices or Company Cars Asset-Light Model

Unlike traditional transport companies or even some ride-hailing platforms, Yango doesn’t invest in owning vehicles or opening local offices. Instead, it relies on partnerships with local service providers who handle all the on-the-ground operations. These partners are responsible for recruiting and onboarding drivers, providing necessary training and certifications, and even managing customer service and logistical support.

By offloading these tasks to trusted local partners, Yango can run a very lean operation with minimal overhead costs. This model allows the company to enter new cities quickly, adapt to local needs more efficiently, and focus more on improving its technology and user experience.

4. Focus on Rider Growth Promotions That Make a Difference

Yango’s goal is not just to join the ride-hailing race it’s to lead it. To build a strong customer base fast, Yango invests heavily in rider-focused promotions. New users often get access to heavily discounted rides, while regular riders enjoy promo codes, cashback offers, and seasonal deals. Referral bonuses for sharing the app with friends also help spread the word quickly.

These promotions aren’t just one-time gimmicks they are part of a long-term growth strategy. By keeping fares low and rewarding users, Yango ensures that more people try the app and keep using it. As more riders join, the platform becomes more active, leading to faster rides and better availability benefiting everyone in the system.

Why Yango Rides Are So Cheap in Nepal ?

Some might wonder how Yango is able to offer such low prices without running at a loss. The answer lies in the thoughtful structure of its business. First, its AI system finds the most fuel-efficient and time-saving routes, helping to reduce the cost of each trip. Second, the company doesn’t spend money on vehicle maintenance, office rents, or large staff salaries, because it doesn’t own cars or operate local offices. This asset-light approach keeps expenses low.

Yango also saves money by using the same core technology in every country it operates in. Whether it’s Nepal or Nigeria, the back-end systems are largely the same. This reduces development and maintenance costs. Finally, Yango is playing the long game it’s more focused on building a strong network of riders and drivers than making immediate profits. By expanding its user base quickly, the company hopes to gain market share and become a key player before focusing on returns.

The Competitive Landscape Yango vs Pathao vs inDrive

Nepal’s ride-hailing market is now more competitive than ever. Pathao enjoys strong local presence and brand recognition, while inDrive offers a unique price-bargaining feature. However, Yango brings global tech muscle and operational efficiency to the table.

| Feature | Yango | Pathao | inDrive |

| Pricing Model | AI-based dynamic pricing | Surge-based | Rider-set pricing |

| Commission (to driver) | 10–15% | 20–30% | 15–25% |

| Local Support Model | Partner-led | Centralized offices | App-based support |

| Fleet Ownership | None | Partial | None |

| Promo Activity | Frequent & aggressive | Occasional | Limited |

| Expansion Focus | Scalable cities | Primarily urban hubs | Major cities only |

Impact on Nepal’s Ride-Hailing Ecosystem

Yango’s arrival has pushed the industry to innovate. Pathao and inDrive are now under pressure to improve both driver incentives and rider discounts. There’s also a growing call for regulatory clarity, as new players like Yango reshape the competitive environment.

For drivers, Yango introduces a more profitable alternative, especially as fuel prices rise and margins shrink. For consumers, it offers a cheaper, faster option particularly during rush hours when surge pricing hits hardest on other platforms.

A Case Study from Pakistan What Nepal Can Expect

Yango’s entry into Nepal closely follows a strategy it previously used in Pakistan, offering clear insights into what Nepali cities can expect next. In Pakistan, Yango launched in four major cities within just six months by operating with a lean setup: instead of establishing expensive offices, the company relied on coworking spaces and kept its core team small, with fewer than 15 employees. The majority of its day-to-day operations including driver onboarding, customer support, and local logistics—were handled by local partners, allowing Yango to minimize costs while scaling rapidly. This partner-led and tech-driven model enabled the company to adapt quickly to local market dynamics, optimize pricing, and offer competitive fares without sacrificing service quality. Experts believe a similar approach is already unfolding in Nepal. Having started in Kathmandu and Pokhara, Yango is expected to expand into fast-growing urban areas like Butwal, Bharatpur, Itahari, and Dharan, where demand for affordable, tech-enabled mobility solutions is on the rise. With its proven success in Pakistan, Yango’s strategy in Nepal is likely to emphasize speed, efficiency, and deep local collaborationreshaping ride-hailing in more regions across the country.

Can Yango Sustain Its Disruption in Nepal?

Yango’s current pricing strategy may appear aggressive, but it is far from unsustainable. The company’s tech-first approach, lean operational structure, and solid backing from a global tech giant provide it with a strong competitive edge. However, maintaining its momentum in Nepal will require more than just low fares. Long-term success will depend on consistently high levels of driver and rider satisfaction, aligning operations with Nepali regulatory frameworks, and expanding into smaller but rapidly growing cities that hold untapped potential. Additionally, Yango will need to stay agile by responding to the evolving preferences and expectations of local users. Despite these challenges, Yango’s emphasis on affordability, efficient decentralization, and smart pricing positions it as a strong contender to redefine the future of ride-hailing in Nepal’s urban and semi-urban markets.

Driving the Future of Urban Mobility in Nepal

Yango’s launch in Nepal is more than just another app going live; it’s a sign that the mobility landscape is shifting toward tech-led, cost-efficient solutions. With AI at its core, a lean business model, and a sharp focus on user affordability, Yango is setting new benchmarks for what ride-hailing can look like in emerging economies.

For riders, it means cheaper and smarter commutes. For drivers, it offers better earnings with fewer restrictions. And for the industry, it raises the bar forcing innovation, accountability, and evolution.