Trump’s Middle East Trip Sparks Business Conflict Concerns

President Donald Trump’s recent Middle East trip, starting May 13, 2025, has drawn attention for its focus on economic deals and potential conflicts with his family’s business interests.

The four-day Gulf tour, kicking off in Saudi Arabia, aims to secure massive investments for the U.S. while navigating regional tensions.

Critics highlight the overlap between Trump’s official duties and the Trump Organization’s growing ventures in the region, raising ethical questions. Here’s a breakdown of the trip, its background, and its implications.

Background of Trump’s Gulf Ties and Past Visits

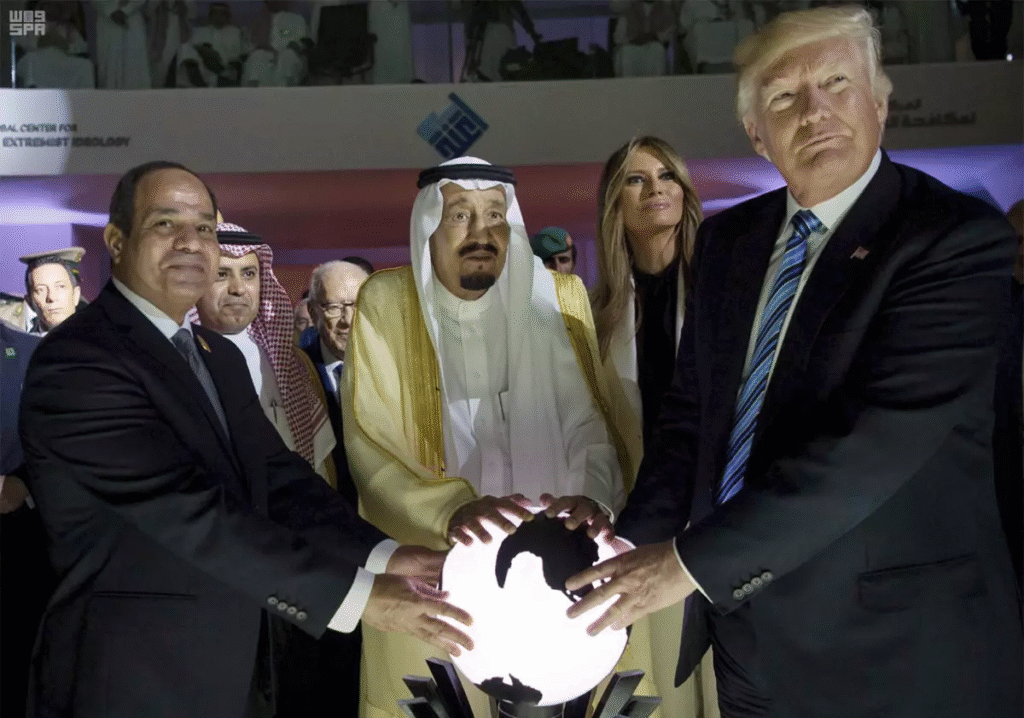

Trump has long prioritized the Gulf states, particularly Saudi Arabia, for their wealth and deal-making potential. His first foreign trip as president in 2017 was to Riyadh, where he

agreements worth hundreds of billions. That visit, marked by a ceremonial sword dance and a glowing orb photo, set the tone for his preference for Gulf monarchies over traditional allies like Canada or the UK. Since then, the Trump Organization has expanded its footprint in the region, with real estate and golf projects in Saudi Arabia, Qatar, and the UAE.

(Saudi Press Agency via Associated Press)

The Trump family’s business ties have deepened. In 2022, Jared Kushner, Trump’s son-in-law, secured a $2 billion investment from Saudi Arabia’s sovereign wealth fund. Eric Trump and Donald Trump Jr., who now run the Trump Organization, recently oversaw deals in the UAE and Qatar, including a Trump-branded hotel in Dubai and a development in Doha.

These ties have fueled concerns about conflicts of interest, especially as Trump’s second term began in January 2025. Posts on X and reports from outlets like The Wall Street Journal note growing scrutiny over how these ventures might influence U.S. foreign policy.

Before the trip, Trump’s administration achieved diplomatic wins, including a ceasefire between India and Pakistan and the release of American-Israeli hostage Edan Alexander from Hamas. These moves framed the Gulf tour as a chance to build on diplomatic momentum while chasing economic gains. However, the focus on business over geopolitics, as noted by CNBC, has sidelined issues like the Gaza conflict and Iran’s nuclear program.

Gulf Tour Events Saudi Arabia and Beyond

Trump landed in Riyadh on May 13, 2025, greeted warmly by Crown Prince Mohammed bin Salman. The visit began with a state dinner and a Saudi-U.S. Investment Forum, attended by U.S. business leaders like Tesla’s Elon Musk, BlackRock’s Larry Fink, and Nvidia’s Jensen Huang. The forum, covered by CNN and The Washington Post, focused on securing investments in AI, energy, and minerals. Trump met with Gulf Cooperation Council leaders, including those from Qatar and the UAE, to discuss trade and defense deals.

On May 14, Trump traveled to Qatar, visiting the U.S. military’s Al Udeid Air Base and meeting Emir Tamim bin Hamad Al Thani. Talks centered on a $200-300 billion investment package, including a Boeing aircraft deal and MQ-9 Reaper drone purchases, per Axios. Controversy swirled over Qatar’s offer of a luxury Boeing 747-8 as a potential Air Force One, which critics, including NPR, called a violation of the Foreign Emoluments Clause.

The trip concluded in the UAE on May 15, where Trump met President Sheikh Mohammed bin Zayed Al Nahyan. The UAE pledged $1.4 trillion over a decade for U.S. AI, semiconductors, and energy, building on a March 2025 commitment. Reuters reported discussions on a civil nuclear-cooperation agreement with Saudi Arabia, allowing limited uranium enrichment under U.S. oversight.

Unlike his 2017 visit, Trump avoided Israel, focusing solely on Gulf states. This shift, noted by The Jerusalem Post, reflects stalled Saudi-Israel normalization efforts amid the Gaza war. Trump’s itinerary prioritized economic wins over regional crises, a strategy Forbes described as “business-first.”

Investments and Business Conflicts

Trump’s trip aimed to secure $1 trillion in deals, per Axios, with Saudi Arabia alone pledging $600 billion over four years. The UAE’s $1.4 trillion commitment and Qatar’s $200-300 billion package push total investments toward $2 trillion. These deals span AI, energy, military sales, and minerals, with Saudi Arabia eyeing $100 billion in arms purchases. The Guardian reported potential “trillions” in joint investments, though specifics remain unclear.

However, the Trump Organization’s ventures in all three countries—Trump-branded hotels in Dubai and Doha, and golf projects in Saudi Arabia—raise red flags. Business Insider noted that Eric Trump’s April 2025 deal with Saudi-linked Dar Global for a Dubai hotel ties the family business to Gulf governments. CREW, a watchdog group, warned that Trump’s foreign policy decisions could directly benefit his personal wealth, citing his Gulf projects and the Saudi-backed LIV golf tour hosted at Trump properties.

The White House dismissed conflict concerns, with press secretary Karoline Leavitt calling them “ridiculous” in a May 10 briefing. Still, NPR reported that ethics experts see a blurred line between Trump’s public role and private gains, especially with Qatar’s plane gift. The Washington Post highlighted that the Trump Organization’s expansion since 2017 makes this term’s conflicts “more significant than ever.”

China’s Tariff Deal: A Strategic Win

On May 12, 2025, the U.S. and China agreed to pause triple-digit tariffs, a move Trump touted before departing for the Gulf. Reuters reported that the deal, brokered after weeks of talks, aimed to ease trade tensions. Chinese leader Xi Jinping criticized Trump’s trade war but welcomed the pause, which benefits both economies. The agreement, per TIME, supports Gulf investments by stabilizing global markets, as Gulf states rely on U.S.-China trade.

Data from the U.S. Trade Representative shows that tariffs had cost U.S. consumers $200 billion annually. The pause is expected to save $50 billion in 2025, per Bloomberg estimates, boosting U.S. industries like tech and manufacturing. Gulf states, particularly the UAE and Saudi Arabia, gain from increased U.S. demand for AI chips and energy, aligning with their $2 trillion investment plans. Trump’s tariff cut, paired with Gulf deals, positions the U.S. as a hub for tech and energy innovation.

Winners and Data Insights

The U.S. economy stands to gain most, with $2 trillion in Gulf investments projected to create 500,000 jobs by 2030, per a U.S. Chamber of Commerce estimate. Tech firms like Nvidia and Boeing benefit from AI and aircraft deals, with Boeing’s Qatar contract valued at $50 billion. Saudi Arabia’s $100 billion arms deal supports U.S. defense giants like Lockheed Martin. The UAE’s $1.4 trillion pledge boosts AI startups, with 20% of funds earmarked for Silicon Valley, per Forbes.

Gulf states also win, gaining access to U.S. tech and military hardware. Saudi Arabia’s nuclear deal strengthens its energy sector, while Qatar’s drone purchases enhance its defense. However, Israel loses out, sidelined by Trump’s Gulf focus and stalled normalization talks, per Reuters. Iran faces increased pressure from U.S.-Gulf defense cooperation, with no direct talks during the trip.

Trump’s family benefits financially, with the Trump Organization’s Gulf projects valued at $500 million, per Business Insider estimates. This personal gain fuels criticism, as posts on social media highlight public unease over Trump’s dual roles.

Data from CREW shows that Gulf investments in Trump properties have risen 300% since 2017, intensifying conflict concerns.